Loan collection management involves complex challenges that traditional methods fail to address effectively:

Missed payment reminders result in delayed collections and increased default rates

Manual tracking of field agent visits provides no verification of actual customer meetings

Paper-based collection receipts get lost or manipulated without audit trails

Lack of real-time visibility prevents managers from monitoring collection performance

Disconnected communication channels delay escalation of non-performing accounts

Spreadsheets cannot handle the dynamic requirements of loan portfolios with varying EMI schedules, interest calculations, and customer communication needs across multiple collection agents operating in different territories.

Digital loan collection apps eliminate these inefficiencies through automated payment reminders, GPS-verified field visits, instant receipt generation, real-time collection dashboards, and seamless escalation workflows that transform reactive recovery into proactive portfolio management.

What Makes No-Code Loan Collection Apps Superior

Generic loan management software forces financial institutions to work within rigid structures that don't accommodate their specific lending products, customer segments, or collection strategies.

No-code loan collection apps provide capabilities that traditional solutions cannot match:

Field Visit Verification with GPS: Unlike basic apps, track exact GPS locations where collection agents meet customers, preventing false visit claims and ensuring accountability for field activities across territories.

Offline Collection Recording: Agents working in areas with poor connectivity can record payments and customer interactions offline, with data automatically syncing when connection resumes—critical for rural loan portfolios where internet access is unreliable.

Multi-Channel Automated Reminders: Send payment reminders through email, WhatsApp, and SMS simultaneously based on customer preferences, with scheduled workflows triggering reminders automatically before due dates.

Digital Receipt Generation: Generate professional PDF receipts instantly upon payment collection with company branding, customer details, and digital signatures for legal validity—eliminating manual receipt books.

Photo Documentation: Capture photos of payment proofs, customer interactions, or property conditions during field visits, creating visual evidence that protects both lenders and borrowers in case of disputes.

Real-Time Collection Analytics: View live dashboards showing collections by agent, territory, product type, and time period with bar graphs and pie charts for instant performance insights.

These features combined create a comprehensive loan collection ecosystem that generic software cannot replicate without extensive customization costing thousands of dollars.

App Structure for Loan Collection System

App 1: Loan Master Database

Section: Borrower Information

Field Type | Label | Configurations |

|---|---|---|

Unique ID | Loan Account Number | Auto-generate, Prefix: "LN-", Start from: 10001 |

Single Line Text | Customer Name | Required: Yes, Character Limit: 100 |

Number | Mobile Number | Required: Yes, Validation: 10 digits |

Customer Email | Validation: Email format | |

Multi-line Text | Customer Address | Required: Yes, Character Limit: 300 |

Section: Loan Details

Field Type | Label | Configurations |

|---|---|---|

Dropdown | Loan Type | Options: Personal Loan, Business Loan, Vehicle Loan, Home Loan; Required: Yes |

Number | Loan Amount | Required: Yes, Currency format |

Number | Interest Rate (%) | Required: Yes, Decimal places: 2 |

Number | Tenure (Months) | Required: Yes, Minimum value: 1 |

Formula | Monthly EMI | Auto-calculate using loan amount, interest rate, tenure |

Date | Loan Disbursement Date | Required: Yes |

Number | EMI Due Day | Options: 1-31, Required: Yes |

Section: Collection Assignment

Field Type | Label | Configurations |

|---|---|---|

Single Line Text | Assigned Collection Agent | Required: Yes |

Dropdown | Collection Territory | Options: Zone A, Zone B, Zone C, Zone D |

Dropdown | Loan Status | Options: Active, Overdue, NPA, Closed; Default: Active |

App 2: Collection Records

Section: Collection Information

Field Type | Label | Configurations |

|---|---|---|

Unique ID | Collection ID | Auto-generate, Prefix: "COL-", Start from: 5001 |

Data from App | Select Loan Account | Source: Loan Master Database, Display: Customer Name + Loan Number, Fetch: All loan details |

Single Line Text | Collection Agent Name | Required: Yes, Auto-fill from user |

Date Time | Collection Date | Auto-capture: Yes, Required: Yes |

Location | Visit Location | Auto-capture GPS, Required: Yes |

Section: Payment Details

Field Type | Label | Configurations |

|---|---|---|

Dropdown | Payment Type | Options: EMI Payment, Part Payment, Full Settlement, Advance Payment; Required: Yes |

Number | Amount Collected | Required: Yes, Currency format, Minimum value: 0 |

Dropdown | Payment Mode | Options: Cash, Cheque, Online Transfer, UPI; Required: Yes |

Single Line Text | Transaction Reference | Show when mode is not Cash, Character Limit: 50 |

Camera | Payment Proof Photo | Allow multiple: Yes, Maximum: 3 |

Section: Customer Interaction

Field Type | Label | Configurations |

|---|---|---|

Dropdown | Customer Met | Options: Yes, No, Not Available; Required: Yes |

Multi-line Text | Interaction Notes | Character Limit: 500, Placeholder: Customer response, concerns, commitments |

Dropdown | Payment Commitment | Options: Will Pay Next Visit, Promised by Date, Refused to Pay, Financial Difficulty |

Date | Committed Payment Date | Show when commitment given |

Camera | Property/Customer Photo | Document visit evidence |

Signature | Customer Signature | Required when payment collected |

Section: Outstanding Calculation

Field Type | Label | Configurations |

|---|---|---|

Formula | Total Outstanding | Fetch from loan master, subtract collected amount |

Formula | Overdue Amount | Calculate based on missed EMIs |

Formula | Collection Efficiency | (Amount Collected / Target) × 100 |

App Interconnection: Collection Records connects to Loan Master Database via Data from App block, automatically loading complete loan details including customer information, outstanding amounts, and payment history when agents select a loan account, ensuring accurate collection tracking.

Step-by-Step Guide to Building Loan Collection System

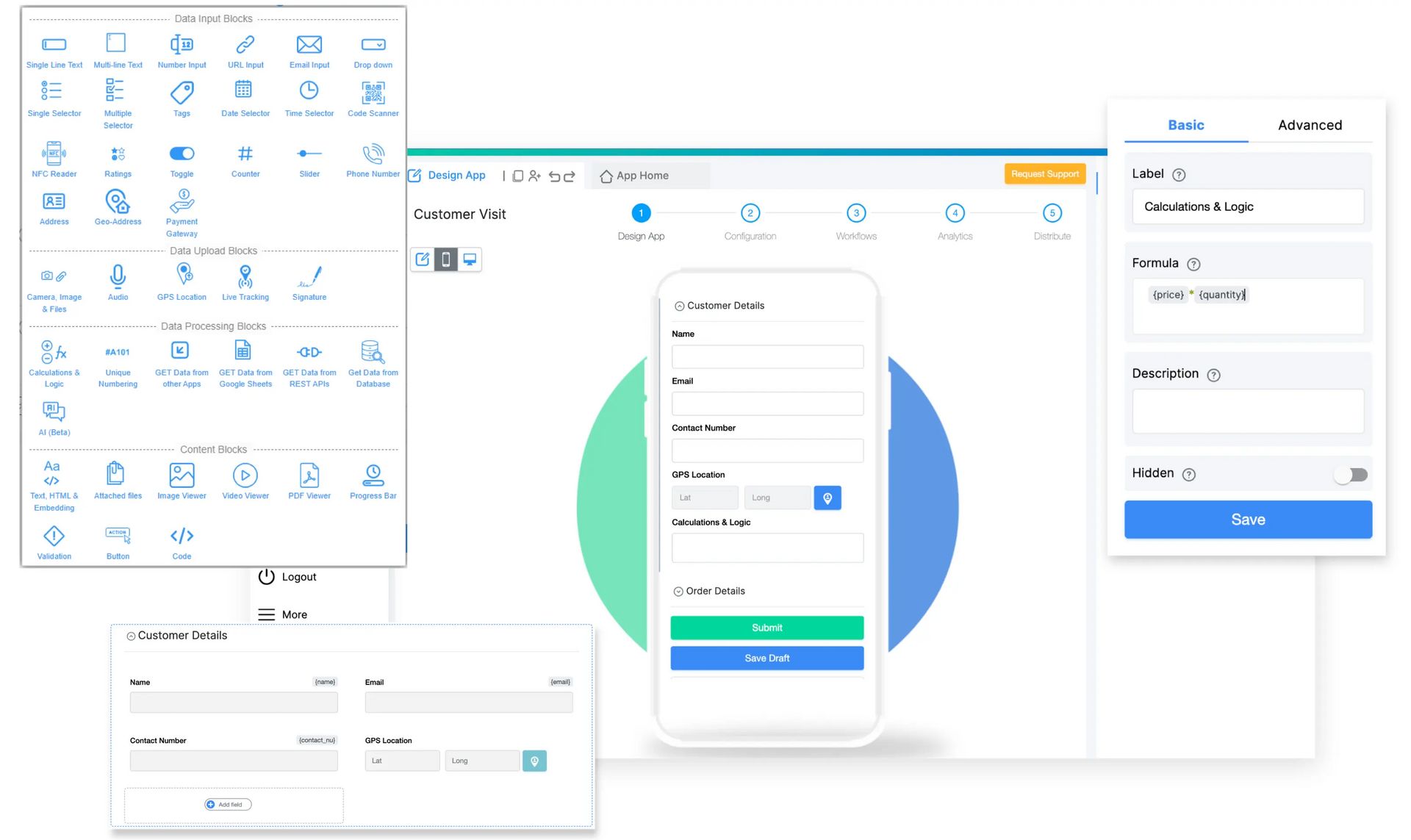

Step 1: Create Workspace and Loan Master Database

Sign up and establish your workspace using the app creation guide. Build the "Loan Master Database" app with all borrower information, loan parameters, and collection assignment details. Configure Unique ID generation for loan account numbers, ensuring every loan has a distinct identifier for tracking throughout its lifecycle from disbursement to closure.

Step 2: Build Collection Records App with Dynamic Data Loading

Create the "Collection Records" app and configure the Data from App block to pull complete loan information when agents select accounts. This automatically loads customer details, outstanding balances, EMI schedules, and payment history, eliminating manual data entry errors and ensuring agents have all necessary information during field visits or phone collections, improving collection efficiency and customer service quality.

Step 3: Implement Automated Payment Reminders

Set up scheduled workflows that trigger automatically 3 days before EMI due dates. Configure multi-channel reminders sending emails with payment links, WhatsApp messages with outstanding amount details, and SMS notifications to customer mobile numbers. Create escalation workflows that send stronger reminders when payments become overdue, with different message templates for 1-day, 7-day, and 30-day delays.

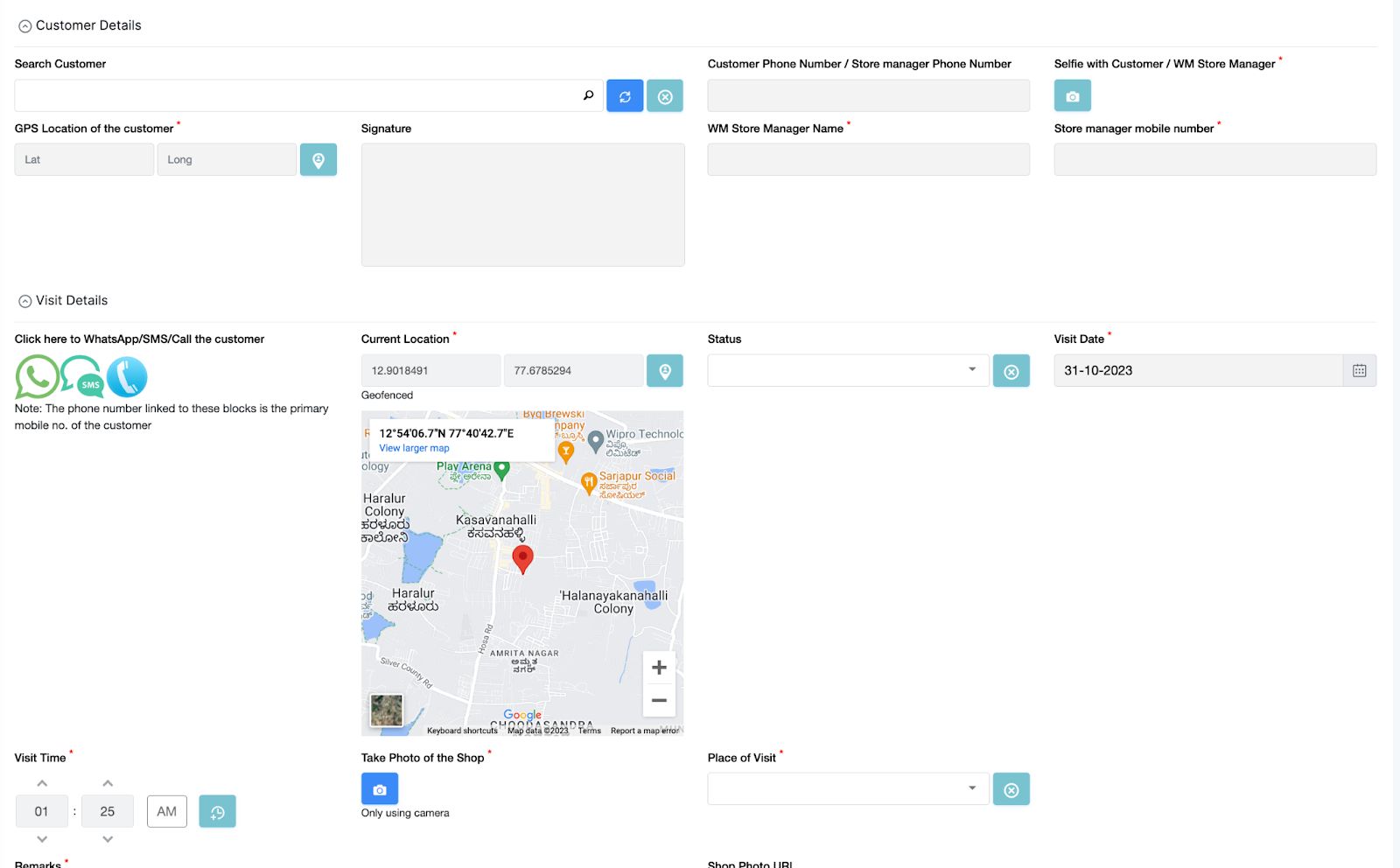

Step 4: Configure GPS-Based Field Visit Tracking

Add GPS location blocks that automatically capture agent locations during customer visits, creating verifiable proof of field activities. Configure geofencing alerts that notify supervisors when agents enter or leave designated collection territories. Generate reports showing agent movement patterns, visit frequency per territory, and time spent at each customer location, ensuring accountability and optimizing territory coverage for maximum collection efficiency.

Step 5: Design Digital Receipt Generation System

Configure PDF generation that creates professional collection receipts instantly upon payment recording. Include company letterhead, customer details, payment amount, outstanding balance, and digital signatures from both agent and customer. Enable automatic email delivery of receipts to customers and integration with accounting systems for seamless financial record-keeping and audit compliance.

Step 6: Build Real-Time Collection Dashboards

Create comprehensive analytics dashboards displaying daily collections by agent, territory-wise performance comparisons, product-wise collection rates, and trend analysis over time. Use bar graphs showing agent performance rankings and pie charts depicting collection distribution across loan products. Configure custom views for different management levels—branch managers see their territory data while regional heads access consolidated multi-territory reports.

Step 7: Set Up Overdue Account Escalation Workflows

Implement approval workflows that automatically escalate accounts based on overdue days. Accounts overdue by 15 days trigger notifications to senior collection officers, 30-day overdues alert branch managers, and 90-day+ overdues go to legal teams for recovery action. Create automated task assignments routing difficult cases to specialized recovery agents while keeping standard collections with regular field staff, optimizing resource allocation.

Step 8: Configure Role-Based Access and Data Security

Establish role-based permissions ensuring collection agents access only their assigned loan portfolios while supervisors view all agents under their management. Restrict sensitive financial data like interest rates and profit margins to management levels only. Implement audit logs tracking every data modification, payment recording, and report generation for regulatory compliance and fraud prevention in loan collection operations.

Industry-Specific Applications

Microfinance institutions manage large portfolios of small-ticket loans across rural areas where agents need offline capabilities and vernacular language support. The system tracks daily collection rounds, aggregates small payments from multiple borrowers, and provides territory-wise profitability analysis essential for microfinance operations.

NBFC companies handling vehicle and equipment loans use the app to verify asset conditions during collection visits through photo documentation, track repossession activities, and coordinate with legal teams for recovery actions on non-performing assets, maintaining complete documentation for regulatory audits.

Banks managing personal and business loan portfolios leverage the system for outbound collection campaigns, tracking call center agent productivity, recording customer promise-to-pay commitments, and automating follow-up schedules based on customer responses, significantly improving collection efficiency.

Conclusion

Building a loan collection app without coding eliminates the compromises of generic software while providing:

Automated payment reminders across multiple communication channels

GPS-verified field visits preventing false activity claims

Instant digital receipt generation with legal validity

Real-time collection performance visibility

Complete audit trails for regulatory compliance

No-code development enables financial institutions to create collection systems matching their exact lending products, customer segments, and recovery strategies without IT dependencies.

Ready to improve collection efficiency and reduce defaults? Create your account and build a custom loan collection app tailored to your portfolio. Explore powerful features and discover flexible pricing that scales with your loan book.

Related Articles: